The University/OIA does not currently provide assistance to students wanting to apply for an ITIN. Students needing an ITIN will be able to use SPRINTAX to apply for one with their tax return filings in February/March. For more information regarding taxes and how to file, please see Tax Responsibilities for International Students and Scholars.

ITIN stands for Individual Taxpayer Identification Number. The Internal Revenue Service (IRS) created the ITIN for use by anyone who is not eligible to apply for a Social Security Number (SSN) and who receives taxable money, such as scholarships, stipends, or awards from the University. If you already have a SSN, have ever had an SSN, or are eligible to apply for an SSN, you are not eligible to apply for an ITIN. Should you apply for an ITIN now and later get a SSN, this will not cause any problems. You will simply start to use the SSN instead of the ITIN (to file taxes, submit to payroll, etc.) as soon as you receive it.

If you are receiving a scholarship, grant, or monetary award from the University, you may require proof that you have applied for an ITIN before you can receive your check.

You might use an ITIN to:

- Receive a stipend or any part of a tuition grant if you are a student or postdoctoral fellow.

- Complete part of an application for an educational loan.

- Accept a one-time payment such as an honorarium for delivering a lecture.

- File your annual U.S. federal tax return if you've received taxable money in the U.S.

Do I Need an ITIN?

The the most common reasons F-1 students apply for an Individual Taxpayer Identification Number (ITIN) is to (1) receive payment for a stipend, fellowship or grant, (2) complete an application for an educational loan, or (3) open an interest-bearing or brokerage account.

In most cases, someone in your Dean of Students office, departmental HR, or financial administrator for your department will let you know if you need an ITIN. Additionally, you may receive an email from Payroll letting you know you need to apply for an ITIN and provide a signed ITIN Application Receipt to receive your award.

Do not submit an ITIN application if you are employed or have a job that will start soon. If you are or will be employed, you will be eligible to apply for a Social Security Number (SSN) instead.

The ITIN application is to apply for a tax ID number only; you will need to work with your Dean of Student's office directly to receive your award.

How Do I Apply for an ITIN at OIA?

1: Prepare ITIN Application Documents

Applying for an ITIN is only an application for a U.S. tax identification number through the U.S. Internal Revenue Service (IRS), the government agency that manages taxes in the U.S. Although an ITIN application is needed to receive your award from the University, the ITIN application is completely separate from the University process of receiving your award money. The documents listed below are for the governmental ITIN application only and may not be the same documents you need to complete your paperwork with the University. Follow up with your Dean of Student's office if you have any questions about documents needed to process your award.

ITIN Application Documents:

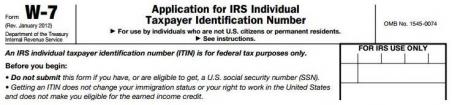

- Completed Form W-7 : You must fill this out exactly as the instructions below explain (see samples to the upper-right). This must be an original and cannot be a copy.

-

W-8BEN (Students from tax treaty countries only; see instructions below and sample to the upper-right)

- NOTE: The W-8BEN may be used for multiple purposes. The information above applies to requirements for the ITIN application only (the application to the IRS). You may need a different or separate W-8BEN to complete your University paperwork and receive your award, even if you are not from a tax treaty country.

- Certified copy of passport biographic page*

- Copy of your student visa sticker (F or J)

- Copy of your most recent I-94 Arrival Record

- Copy of your I-20 or DS-2019

- University award or loan letter (letter from your department stating you are receiving taxable money from the University). Does not need to be original. Can be a copy or email printout.

- Letter from OIA verifying visa status and SSN ineligibility. To request, please email: international-affairs@uchicago.edu

*NOTE: certified copies of a passport can be obtained through your home country's consulate. For a list of consulates located in Chicago: https://www.embassypages.com/city/chicago Please do not send your original passport to the IRS as it will not be returned!

Instructions to complete the W-7

It is important that you read and follow these instructions, section by section. The IRS is very particular on how you file this form (especially the address portion). Type on form or use black ink. Do not leave any blanks; write 'N/A' if something does not apply to you. If you are unsure, leave a field blank and we will cover it during the workshop.

-

TOP: Reason you are submitting Form W-7:

-

Student from a tax treaty country (must match passport):

- Check both boxes 'f' and 'h' only. Do not check any other boxes.

- f - Nonresident alien student filing a U.S. tax return or claiming an exception

- h – all applicants check this box (and write the following)

- Write: 'Exception 2(b) - Scholarship Income' (must also include treaty country and article number – see page 2 of W-8BEN Form for needed information)

-

Student not from a tax treaty country:

- Check both boxes 'f' and 'h' only. Do not check any other boxes.

- f – Nonresident alien student filing a U.S. tax return or claiming an exception

- h – all applicants check this box (and write one of the following)

- Write: 'Exception 2(c) - Scholarship Income'

-

Student from a tax treaty country (must match passport):

- Name – should appear exactly as written in passport

-

MAILING ADDRESS: Use your U.S. residential address.

LINE 1: Street number, street name, apartment or unit #

LINE 2: Chicago, IL 60637 - Foreign Address (non U.S. address) must be filled in

- Birth information – must match passport

- 6a – Country of citizenship. Write entire name and do not use abbreviations. This must match country listed on I-20 and passport.

- 6b – write 'N/A'

-

6c – F-1 or J-1, visa number (see red # listed on visa). Do not enter visa expiration date. Write D/S 'duration of status' instead of visa expiration date.:

- Example: F-1, C8835628, D/S

- Canadian passport holders: F-1, Canadian – no visa

- 6d – check passport, and fill in country of issue, passport number, expiration date and most recent entry date to U.S.

- 6e –Check 'No'

- 6f - Write 'N/A' in name fields

- 6g – write 'University of Chicago' and 'Chicago, IL', duration of program should be taken from I-20 or DS-2019, (e.g. '45 months')

- Sign, date and provide phone number

Instructions to complete the W-8BEN

-

For ITIN applications, W-8BEN Form is ONLY required if you put Exception 2(b) on the W-7

- The University may require a W-8 for all students for internal Payroll or University purposes. However, for the ITIN application itself, a W-8 is needed ONLY if you are from a tax treaty country (exception 2B on the W-7)

- Complete Part I of this form and sign it. Parts II and III should be left blank for this application.

- This copy is for ITIN applications only. We cannot provide guidance on other uses of the form, such as claiming tax treaty benefits.

2: Submit ITIN Application to IRS

Please follow these steps to complete and submit your ITIN application to the IRS.

- Review W-7 instructions to ensure you have completed all steps and have a complete list of required documents.

- Mail your application to the IRS per instructions on W-7

-

The IRS will receive and process your application

- It typically takes 2-3 months for the IRS to approve your application. The IRS will not expedite ITIN applications.

- The IRS will mail your ITIN approval/rejection notice to the address you listed.

- Once you receive your approved ITIN, you will want to provide it to University Payroll: payroll@uchicago.edu

How can I receive my scholarship/award?

Applying for an ITIN is just one step in receiving your University award. You do not need to have the actual ITIN number to receive your award, but may be asked to apply for an ITIN as part of the process of receiving these funds. If you have any questions, please follow up with your department or Dean of Student's office directly.

ITINs and Taxes

If you are receiving a taxable scholarship or stipend, you will require your actual ITIN number to file your tax return. The IRS takes about 6-8 weeks to process ITIN applications. If you need your ITIN to file taxes, you will be able to do so utilizing tax assistance software sent to international students in late-February/early March each calendar year.

If you are from a tax treaty country and you have your actual ITIN number, you may be able to reclaim some or all of the withheld tax from your University award or stipend. Contact your departmental HR or financial office for more information. Because advisers in our office are not tax experts, OIA will not be able to advise you on if or how you can get a tax refund or other individual tax matters.